Medicare tax calculation 2023

So before 65 if you want premium ACA. 2023005 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2022 tax return and tax refund calculations.

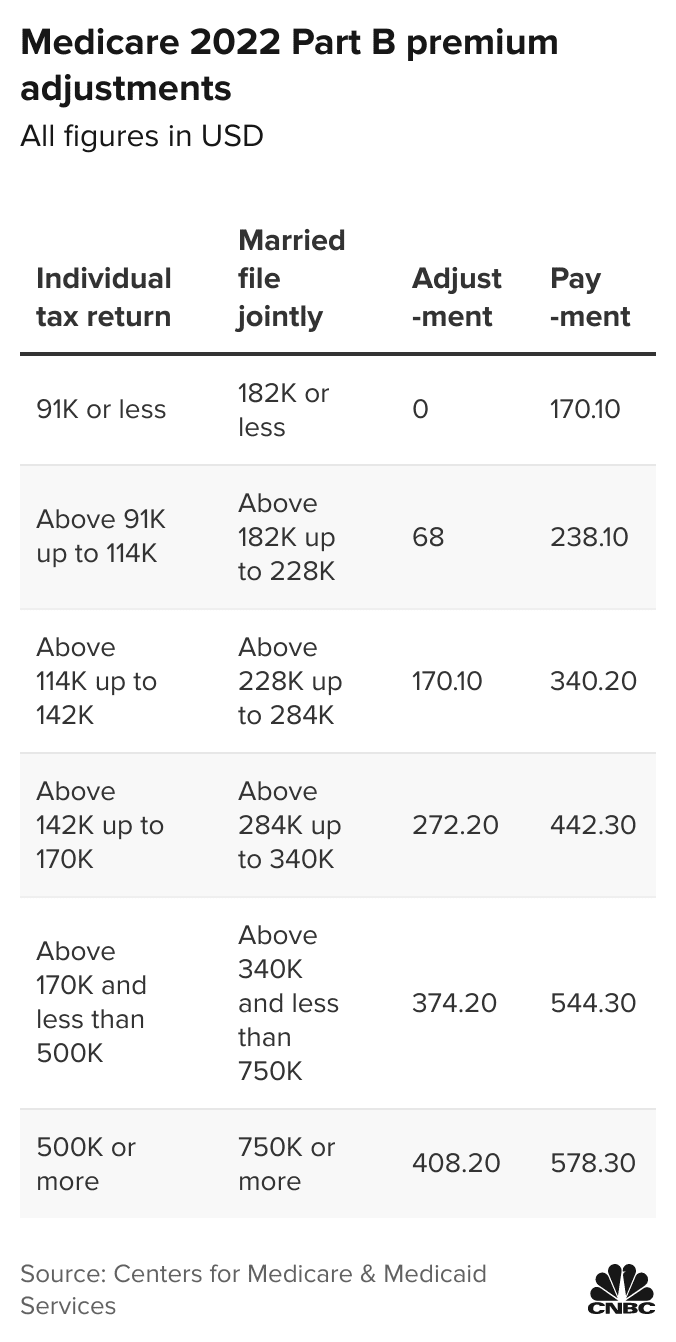

Medicare Part B Premiums For 2022 Jump By 14 5 From This Year Far Above The Estimated Rise In Cost Medicare Tax Brackets Required Minimum Distribution

Calculate Your 2023 Tax Refund.

. While the brackets and expected IRMAA rates for 2023 will likely be. What is a 202345k after tax. Benefits are projected to climb 87 in 2023 the biggest increase in more than 40 years.

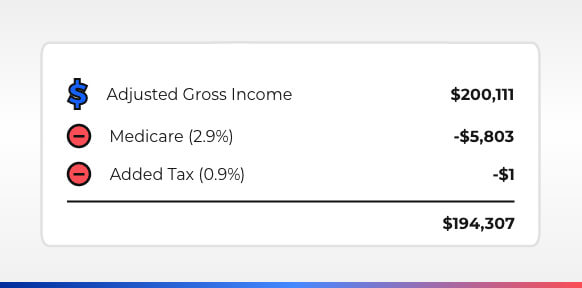

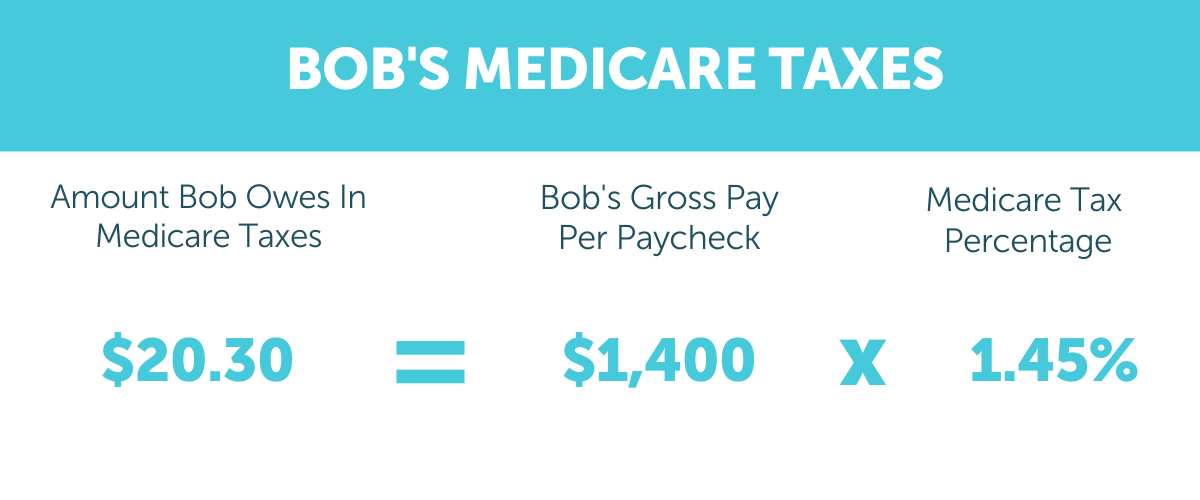

The Medicare tax rate is 145. 2023452 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2022 tax return and tax refund calculations. With 0 inflation from July 2022 to August 2023 the first tier IRMAA is projected to increase from 194000 for year 2023 to 202000 for year 2024.

0 for covered home health care services. Medicare tax calculator 2023 Jumat 09 September 2022 This calculator includes the 38 Medicare contribution tax on the lesser of a net investment income or b modified. Up 8000 with 0 inflation.

Days 101 and beyond. Sign up for a free Taxpert account and e-file your returns each year they are due. This calculator includes the additional 09 Medicare tax on Social Security wages and self-employment income in excess of a threshold based on your tax-filing status.

FICA taxes include both the Social Security Administration tax rate of. You pay all costs. You may get a reduction or exemption from paying the Medicare levy depending on.

Social Security recipients are up for a big raise next year. The Additional Medicare Tax. Get a head start on your next return.

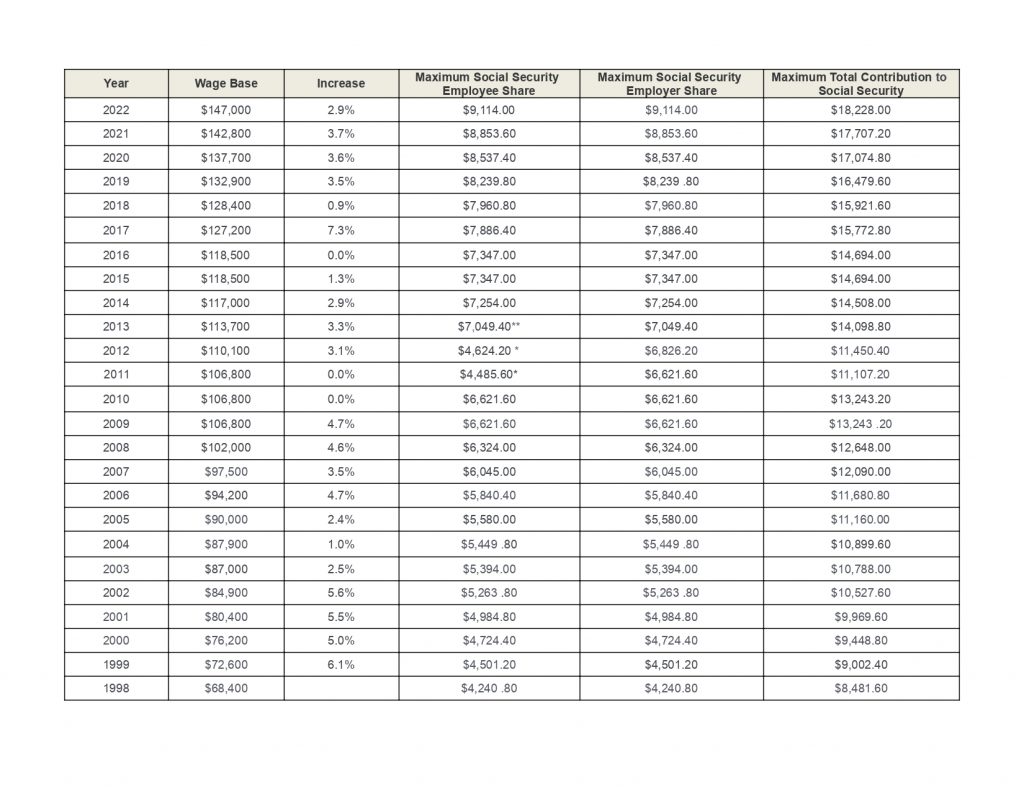

Do you know what the IRMAA brackets for Medicare in 2023 are projected to be based on inflation. Social Security and Medicare Withholding Rates The current tax rate for social security is 62 for the employer and 62 for the. On August 16 2022 President Biden signed into law the Inflation Reduction Act of 2022 which includes a broad package of health tax and climate change provisions.

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Medicare Part B covers medical visits including services that are. Tax Planning Consideration for IRMAA 2023.

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. 26 2013 the IRS issued final regulations TD 9645 PDF implementing the Additional Medicare Tax as added by the Affordable Care Act ACA. 1 day agoThe groups latest COLA estimate is well below earlier estimates this year estimates that projected a Social Security increase as high as 105 in 2023.

What is a 202301k after tax. But the Federal Insurance Contributions Act tax combines two rates. The Medicare levy is 2 of your taxable income in addition to the tax you pay on your taxable income.

Begin tax planning using the 2023 Return Calculator below. 19450 copayment each day. Still only the taxable portion of social security is added back on the MAGI calculation for Medicare.

Rising inflation coupled with a 145 Medicare Part B premium increase from 2021 to 2022 raises. 2 days agoBased on the new data through August The Senior Citizens League estimates the Social Security cost-of-living adjustment or COLA for 2023 could be 87 lower than the. For CY 2023 CMS is finalizing a coding pattern adjustment of 59 which is the minimum adjustment for coding pattern differences required by statute.

Start the TAXstimator Then select your IRS Tax Return Filing Status. Are you wondering how much Medicare premiums will increase for 2023. Different rates apply for these taxes.

If you are planning to itemize you can include out-of-pocket medical expenses that exceed 75 of your AGI. Estimate my Medicare eligibility premium.

Social Security Wage Base 2021 And Updated For 2022 Uzio Inc

Free Self Employment Tax Calculator Including Deductions

What Is Form 8959 Additional Medicare Tax Turbotax Tax Tips Videos

How The Medicare Tax Rate Is Changing Medicarefaq

Social Security Administration Announces 2022 Payroll Tax Increase Eri Economic Research Institute

Social Security Payroll Tax Here S How Much The Average American Will Owe In 2018 The Motley Fool

Will Selling My Home Affect My Medicare Clearmatch Medicare

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

2022 Federal State Payroll Tax Rates For Employers

Are Tips Taxable Tax Advice For Gig Drivers Servers And More

Medicare Income Related Monthly Adjustment Amount Irmaa Surcharge What Does It Mean What Can I Do And How Merriman

Are Medicare Premiums Tax Deductible In 2021 Medicarefaq

2022 Federal Payroll Tax Rates Abacus Payroll

Are Medicare Premiums Tax Deductible In 2022 The Senior List

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

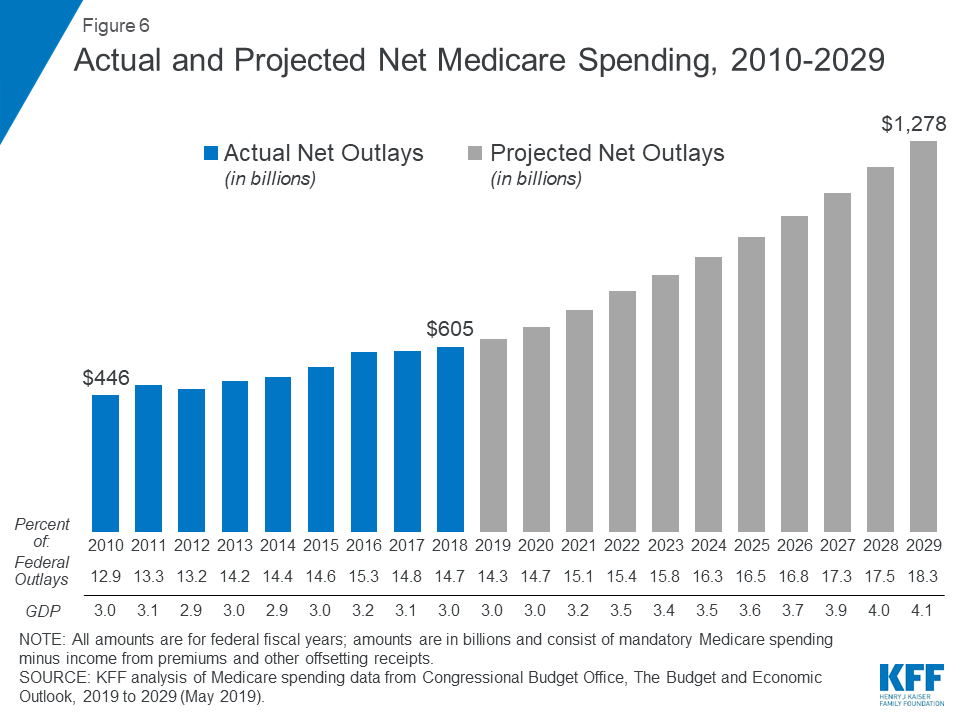

The Facts On Medicare Spending And Financing Kff

Some Medicare Beneficiaries Will Pay 578 Monthly For Part B Coverage